You might be hearing the term “Trade Secrets” more often these days when discussing intellectual property. These are intellectual assets of a company which are not readily known, hold commercial value, and are protected by reasonable measures. Trade Secrets have become progressively more significant in recent years following increased focus in international trade relations.

In China, this new focus has resulted in a rapidly changing environment with new laws and policies being enacted. In case you missed it, we published an article in April on the updated unfair competition law concerning trade secrets in China. Clearly, it’s time to get educated on Trade Secrets. We are following trends within this field closely and extend the commentary to bring you four key updates and trends in Trade Secrets that will impact your operations in China.

Your valued trade secrets are now more enforceable for you AND your competitors

On April 23, 2019, the National People’s Congress (NPC) added several amendments relating to Trade Secrets to China’s Anti-Unfair Competition Law. The changes come into effect November 1, 2019 and are predicted to confer substantial benefits to Trade Secret owners.

In these changes, the definition of Trade Secrets was expanded beyond strictly business and technology-related information. Now, a wider variety of commercial information qualifies for use in Chinese courts. By extending Trade Secrets to encompass all “trade information”, any procedure or system companies use to their benefit can be protected. Additionally, the new changes allow more parties to be implicated in cases regarding Trade Secret theft. Previously, it was only business-affiliated individuals and entities who stole Trade Secrets who could be prosecuted in China. Now, hackers and those who instigate, aid, or encourage trade secret infringement can also face charges. The possible guilty parties have been expanded to include legal counsel and unincorporated organizations. Furthermore, the usage by a third party of a Trade Secret known to be stolen is now specifically an infringement, which increases the business risks involved with new employees. There has also been an increase in the damages that can be awarded by the Courts. All of these developments create more opportunities for effective Trade Secret litigation.

The changes also shift the burden of proof in Trade Secret cases. Previously, those wishing to prosecute Trade Secret theft in China were responsible for proving their entire case: they needed to prove that the information in question qualified as a Trade Secret and that the Trade Secret was taken and used. The evidence required to support this was often difficult to obtain as it was in the defendant’s possession. Come November, a plaintiff will only need to show a prima facie case of Trade Secret theft and then the defendant will need to prove that they did not take and use that Trade Secret. What is required to show a prima facie case remains to be seen but, as Trade Secrets should be more enforceable, we can expect to see an increase in Trade Secret litigation. This, of course, applies both to protecting your Trade Secrets and also to ensuring that you do not inadvertently obtain and use someone else’s Trade Secrets, as can happen when hiring new employees. This begs the question; how well do you monitor and manage your Trade Secrets and the carriers of such secrets?

Trade Secret Litigation in China to Increase?

Over the past few decades, difficulty in enforcing Intellectual Property Rights in China has resulted in low levels of Trade Secret litigation. China’s less comprehensive Anti-Unfair Competition Laws meant that many Trade Secrets cases could not be brought against the correct party or lacked the grounds for a proper case. Unfavorable laws have also meant a weaker incentive for judges to favor plaintiffs or award injunctions and damages. This is not limited to China though, as Trade Secrets as a category have been generally under-litigated internationally.

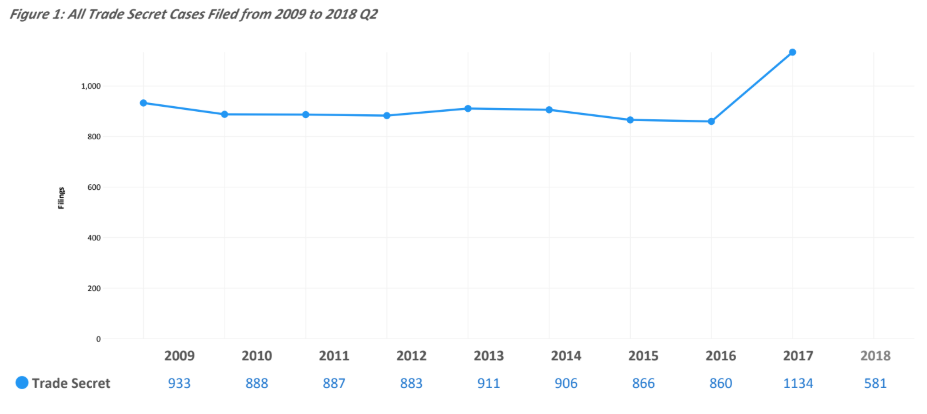

Considering the new amendments to the Anti-Unfair Competition Law, what can we expect in China? The shift in the burden of proof seems to intuitively imply that plaintiffs should succeed in more cases. Broadening potential targets and increasing the damages available should mean that plaintiffs are incentivised to litigate more. But will this actually impact Trade Secret litigation, and to what extent? Recent empirical observations show that globally, new legislation will substantially impact Trade Secret litigation. Observe the Defend Trade Secrets Act passed by the United States Congress in 2016. When the U.S. strengthened Intellectual Property Rights for Trade Secrets by making it a Federal law, the number of cases filed increased significantly in the period of a single year:

Source: https://www.ipwatchdog.com/2018/07/27/reports-increase-trade-secret-litigation-dtsa/id=99646

It is therefore reasonable to predict comparable results for China beginning this November. Given increased confidence in their ability to win cases, entities operating in China will want to take advantage of new developments and pay more attention to Trade Secret issues. While there will be more opportunity to defend your own Trade Secrets, what is your risk exposure for trade secret litigation?

Higher Damages Awarded to Claimants in Trade Secret Litigation

The changes to the Anti-Unfair Competition Law include an increase in damages for “malicious Trade Secret infringement” to an amount five times greater than the benefit reaped by the infringer. The changes also raise the permitted limit of damages for statutory compensation to RMB 5 Million (previously RMB 3 Million).

As the potential to gain climbs, companies need to prepare for “malicious prosecution”, the possibility that competitors will try to use Trade Secret infringement cases to hurt competition or force settlements. Bad Faith claims in the context of a Trade Secret litigation also pose another challenge. When a firm sues for Trade Secret infringement, it may face a counter-suit based on negligence in bringing the case if the case fails. This is particularly so if it is found that the firm could not establish it actually had a Trade Secret. A firm that carelessly takes a Trade Secret case to court may ultimately encounter losses unless it has comprehensive compliance systems to capture, identify and control Trade Secrets. How prepared are you for trade secret litigation as a plaintiff or defendant?

Mounting International Pressure on China

China has long been perceived as a precarious market due to relatively undeveloped IPRs and enforcement systems. Technology import rules have included specific technology transfer requirements and there is also a perception that Chinese firms are more likely to commit Trade Secret theft. As a result, China has been pressured to change its import rules and to allow intellectual property matters to be the subject of negotiation between the parties concerned. Changes have been announced to China’s Foreign Investment Laws to address forced technology transfer and other issues of concern.

Further, in the midst of rising protectionism and the escalating trade tensions, the US Department of Justice rolled out its “China Initiative”. This aims to expedite and resource investigations of priority Trade Secret theft cases, enforce measures preventing technology transfer against U.S. interests, provide attorneys with intelligence, and address supply chain threats. Additionally, the initiative introduces the Foreign Investment Risk Review Modernization Act, which extends US access and jurisdiction over Foreign-US transactions, transfers, and agreements.

The China Initiative demonstrates how the US is extending extraterritorial jurisdiction and protections over Trade Secrets, as well as its commitment to a hardline stance on Chinese firms. Given the interconnectedness of the Chinese and American markets and robust globalization, all Chinese companies, including Chinese subsidiaries of European companies for example, will need to consider policies such as these when conducting operations at home and abroad. A lack of knowledge about Trade Secrets and their management could result in serious problems arising in any dealings with US companies. What is your risk exposure to trade secret leakage?

Conclusion: Trade secrets are becoming an increasingly important asset class to manage appropriately

Every commercial entity has Trade Secrets, regardless of whether they are aware of them. With the increasing focus on Trade Secrets as an asset class, businesses will have no choice but to contend with the potential for increased Trade Secret litigation and the commercial consequences of related business policy and trends. We expect to see Trade Secrets increase in importance in due diligence exercises surrounding company valuation, IPOs and M&A deals. Trade Secret mismanagement therefore poses a business risk that must be considered at Board and Management level.

But how do you prevent leakage of your Trade Secrets, properly prepare a case against a misappropriating entity, or defend yourself from Malicious Prosecution? How do you ensure that you properly identify intangible assets for compliance or other business reasons? Is your business properly prepared for an IPO or are you aware of the true value of a target company?

There exist a variety of preventive and proactive solutions. You can read more about them in the subsequent articles within this series.

Article written with assistance from Samantha Chun.

For more information or inquiries regarding this suite of services, please contact Tim Jackson or Nigel Wong.