What is your technology worth?

Major investments are made in technology and IP, but too often investments lack a clear link to value creation. This is problematic for many reasons, but above all because it leads to an inefficient use of company resources on which, in the absence of clear valuations of their assets, base their investment decisions on factors other than economic ones. What is the relationship between technological innovation and value?

Sooner or later, all companies will face the question "how do you create value?". For some companies, the answer is simple, especially in older and established industries. Perhaps a specific machine is more efficient than its competitors, or they may use a unique material in their manufacture. For many modern companies, it is far from so easy. For companies working with large platforms, systems or ecosystems of technology, it can be very difficult to say exactly where value arises. Also, if a specific value-adding activity can be identified, it is not always obvious how the value of the activity should be allocated to the different parts of the underlying technology.

If there is a lack of insight into what value is created, as well as where it is created and how it is created, it may make it difficult for the company to improve its customer offering in the short-term. Without a clear understanding of the value that the company creates, it is much more difficult to convey it to customers, and later to create new value. If you do not know what to improve, it is difficult to develop; at worst, this means that both the technology and the company can meet a premature death because the company cannot finance itself.

In the long term, this can lead to much deeper problems. A prerequisite for the creation of value in a predictable and long-term manner is the establishment of control – defined as de facto ownership and/or holding over time – of the assets that interact in value creation. In order to do this, it is of course important that you have knowledge of what it is important to protect. Thus, robust processes and a combination of knowledge that work together to identify where value is created, what discrete technical concepts and solutions are involved and how they affect the value of the customer.

Some companies are going too far in the other direction. Instead of doing a proper analysis, they choose to patent everything according to the stubborn "rather safe than sorry". It might work if you are IBM or Microsoft, but for many companies it means bleeding money you don't have. Most people simply cannot afford to work that way; instead they must work smarter.

Once all value-creating activities have been identified and the underlying technology isolated, they can be individually analysed and evaluated, as sub-activities in a value-creation process and as their own units. This process then forms the basis for the type of control that should be developed over the different sub-components.

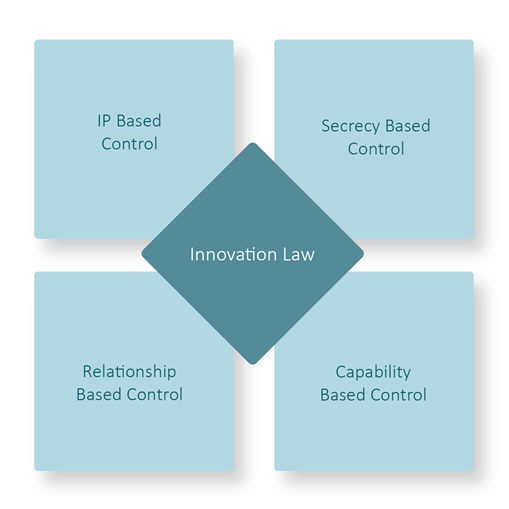

At Rouse, we usually talk about control in four dimensions: IP-based control, privacy-based control, relationship-based control, and capability-based control. These different forms of control all have their own advantages and disadvantages and can also be advantageously combined.

An asset that has a large role in value creation, but is "hidden" from competitors, may not require any specific action. In this case, it may be sufficient to use privacy-based control (e.g. simple NDAs). Another underlying asset may contribute just as much to value but is based on simple and already known technology. It probably requires stronger protection, as it can be more easily copied. In that case, it may be worth applying for a patent.

Similarly, the valuation of an asset can also be used to determine the type of control that needs to be applied. A high valuation can mean that the use of patents or more extensive confidentiality agreements can be made more easily, while a lower valuation may mean using only less costly types of control. Another important point is that the valuation also implies an implicit priority list; it suddenly becomes clear where to start with protective measures.

Lack of control lowers the price of a technology or a company, just as it lowers the price for a competitor to compete with the same or related technology. Lack of control increases risk, lowers the value of innovation and makes it costly or even impossible to compete in the long term. When companies work with platforms, solutions systems, or entire ecosystems of technology with different applications, it can be difficult to see which distinct objects are valuable and business-critical. This complicates the valuation of these objects, which in turn makes it difficult to know what type of control is customary.

This is why such large sums are invested in patents and trade mark registrations; no one knows the value of the underlying objects, and no one dares risk being the one who was not careful enough. As a result, it is usually easier to make a decision to apply for a trade mark or patent than not to do so.

Through a structured approach and an understanding of how economics, technology and law work together to create value, one can avoid wasting the company's valuable resources. You start by identifying where value is created. It then isolates the technical assets that are the prerequisites for the value-creating process, over which effective methods are then created.

What do you think about the relationship between control and competitive advantage? How can you maximize the value of IP?

On 22 September Rouse Stockholm invites you to a webinar on the theme "Technological innovation and value", where we will discuss these types of issues. Participation is completely free of charge for you and your colleagues. To sign up, click here.